Navigating the intricate landscape of tax and financial matters is a daunting task for many, especially for professionals with demanding careers such as physicians. In Melbourne, where the healthcare sector is rapidly evolving, the importance of sound financial management cannot be overstated. For Melbourne physicians, partnering with skilled accountants can be a strategic move towards achieving financial stability and success. In this article, we delve into the complexities faced by physicians in managing their finances and taxes, and explore the invaluable benefits of collaborating with experienced accounting professionals.

Understanding the Financial Challenges of Melbourne Physicians

Physicians in Melbourne are not just medical professionals; they are also entrepreneurs managing their own practices. This dual role brings a multitude of responsibilities, from delivering exceptional patient care to overseeing the financial health of their businesses. However, amidst the hustle and bustle of daily operations, physicians often find themselves overwhelmed by the complexities of financial management. Tax compliance, wealth accumulation, and strategic business planning can quickly become daunting tasks, especially considering the ever-changing landscape of healthcare regulations and tax laws.

Physicians face unique financial challenges that stem from the nature of their profession. They may have irregular income streams, varying from patient consultations to procedural fees, which can make budgeting and financial planning a considerable challenge. Additionally, the burden of student loans and ongoing education expenses adds another layer of complexity to their financial picture. With these challenges in mind, it’s no wonder that many physicians feel ill-equipped to handle their finances effectively.

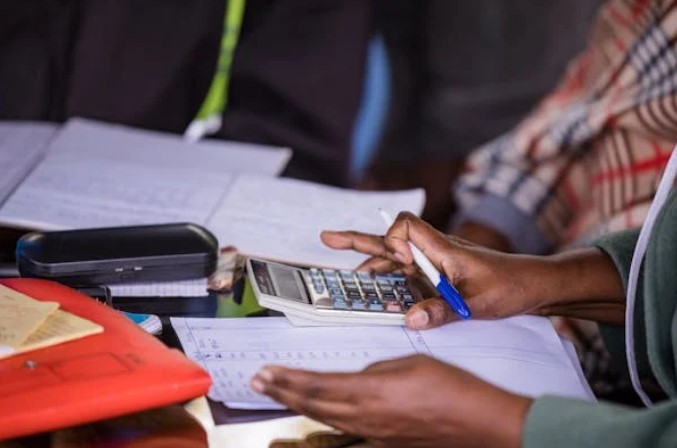

The Role of Accountants

Enter specialized accountants who understand the intricacies of the healthcare industry. These professionals are not just number-crunchers; they are strategic partners who offer tailored solutions to address the specific financial needs of physicians. By partnering with accountants who specialize in healthcare and medical professionals, physicians gain access to a wealth of expertise and support that can alleviate the burden of financial management.

Accountants for doctors understand the unique tax implications and regulatory requirements that impact physicians. They possess in-depth knowledge of tax laws governing medical practices, allowing them to identify opportunities for tax optimization while ensuring compliance with all relevant regulations. From structuring practice entities to maximizing deductions and credits, these accountants employ strategic tax planning strategies to minimize tax liabilities and preserve physicians’ hard-earned income.

Furthermore, accountants play a crucial role in guiding physicians through the maze of financial planning. Whether it’s mapping out a retirement strategy, devising investment plans, or managing debt effectively, accountants work closely with physicians to develop personalized financial plans tailored to their individual goals and circumstances. By taking a holistic approach to financial planning, accountants help physicians achieve not just short-term financial security but long-term prosperity as well. This is where the team at Curve Accountants can help. Check out their website at www.curveaccountants.com.au and learn more about how they professionally handle financial strategies that reflect your profession and drive your long-term wealth.

Benefits of Partnering with Accountants

- Tax Optimization: Accountants specializing in healthcare finance are adept at navigating complex tax laws to maximize deductions, credits, and incentives for physicians. By implementing strategic tax planning strategies, they help physicians minimize tax liabilities and retain more of their income.

- Financial Planning: From retirement planning to investment management, accountants provide invaluable insights and guidance to help physicians achieve their financial goals. By developing personalized financial plans, accountants empower physicians to build wealth and secure their financial future.

- Practice Management: Accountants offer expertise in optimizing practice finances and improving operational efficiency. By analyzing key financial metrics and identifying areas for improvement, they help physicians enhance profitability and sustainability.

- Regulatory Compliance: Healthcare regulations and tax laws are constantly evolving, posing compliance challenges for physicians. Accountants stay abreast of these changes and ensure physicians remain compliant with all regulatory requirements, minimizing the risk of penalties or audits.

- Strategic Decision-Making: As trusted advisors, accountants provide objective financial analysis and strategic insights to support physicians in making informed decisions. Whether it’s expanding practice services, acquiring new equipment, or entering into partnerships, accountants offer financial perspectives to guide decision-making and drive growth.

In an era of increasing financial complexity, Melbourne physicians can benefit greatly from partnering with skilled accountants who specialize in healthcare financial management. By leveraging their expertise, physicians can streamline their financial processes, optimize tax outcomes, and achieve greater financial security. With the support of knowledgeable accountants, physicians can focus their energies on what matters most – providing exceptional patient care while building a prosperous practice for the future.